I was raised to appreciate the value of money and to understand the hard work that went into buying the things I desired. Although I often ignored my parents and spent whatever allowance I was given on clothes (rather than school lunches), they finally (and thankfully) made me get a job so I could truly value and pay for my own things.

My first job was at Abercrombie & Fitch, welcoming customers into the store as I spritzed the ubiquitous perfume and nonchalantly greeted customers with a “Hey! What’s going on!?” However imperfect this or any other job I had was, I am incredibly thankful for the monetary values they instilled in me. I knew exactly how long I had to work in order to afford that $60 Zara sweater I coveted; roughly 6 hours plus the unpaid commute to and from the store. Without the experience of working for my own money, I would have never understood the true value of hard work and what it can (or can't) afford.

Source: wikimedia

When I moved to New York and started to earn more money as a model, I immediately began (at my parent's guidance) investing whatever I had left over after taxes. I chose a diversified portfolio of stocks that were relatively safe as long-term investments, meaning they would sit in my investment account untouched, for what I planned to be at least ten years. I wanted a lump sum that I could have as a backup when and if my career ever slowed down. Modeling can be lucrative however the shelf life of a model can often be short-lived.

While I admit I was proud of myself for taking charge of my accounts and investing what I had, I began to realize that for all the money I claimed to have made modeling for four years in New York, the investments I had in addition to the cash in my bank was simply not that great. I was lucky enough to have money in savings and investments especially at my age but there should have been a lot more. Recently, on a visit to New York, my step dad and I went over my accounts to see if I was where I wanted to be for my future. He calculated my yearly earnings versus the amount I had saved for the past year, one that illuminated the fact that I was spending the most I’ve ever spent and would ever want to spend each month living in New York. To my defense, New York is god damn expensive, as Craig, my step dad understood. He wanted me to live the life I had in New York and was glad I had the choice to do so at my age. However, he wanted me to be aware at all times where my money was going and to see if I was okay with spending that much per month. If I was content spending $5 a day on lattes, that was fine, but I had to understand I would have way less money in my future than I anticipated.

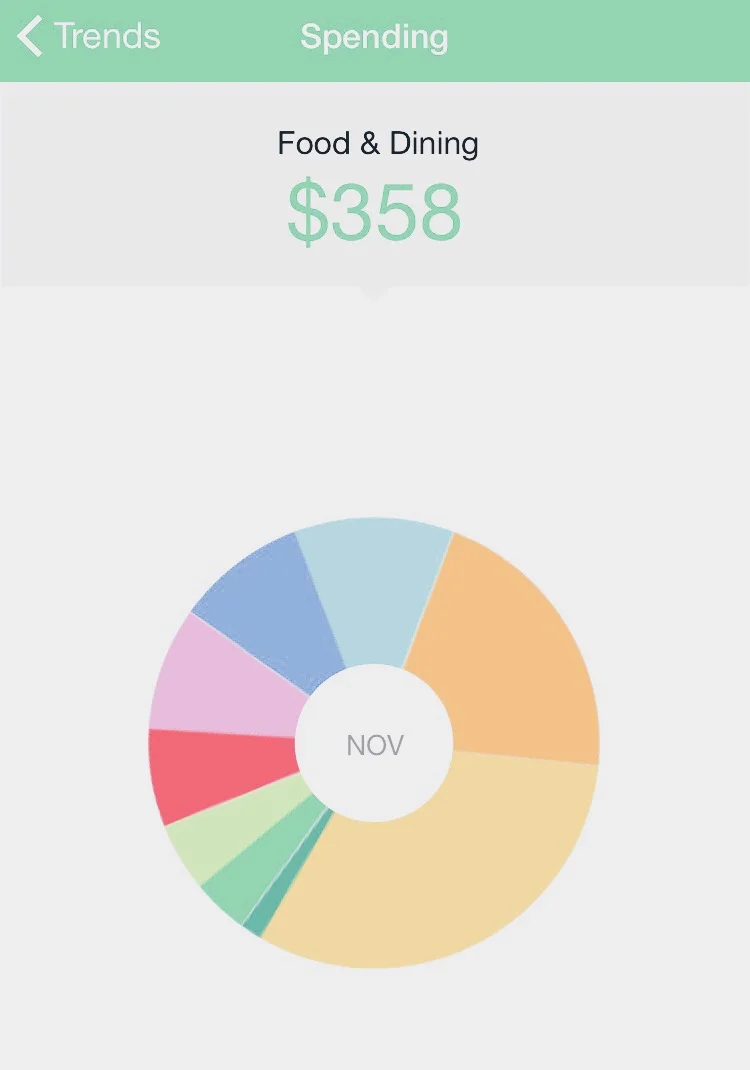

Sign up for Mint for free: HERE!

I immediately checked my Mint account, an app that helps you see exactly where you’re spending your money each month with graphs and chart comparisons, the app that I had downloaded and failed to take one look at. Unfortunately, my dad was right and for the past four years I had been spending on average the high amount he speculated.

I went into a bit of a panic, canceled all my lunches with friends I had coming up that week and tried to figure out how I could fix everything. I realized my nonchalant spending had a huge effect on what I was saving for my future and needed to make some adjustments if I was going to continue to make contributions to my investments or if everything I continued to make would be spent almost immediately.

While I didn't want to cut out everything I enjoyed, the occasional yoga class or buying organic fruits and vegetables, I figured out a few quick fixes I could easily cut down on so I could save bit by bit each day and get back on track.

1) Specialty lattes every day in NYC (on average ~$5-5.50/day)

If I was getting roughly 300 lattes at $5.25 on average per day I was spending $1,575 per year just on coffee!!

*the fix: I immediately went out and bought a French press. It makes delicious coffee that tastes almost exactly like an espresso (especially if you get the small 3-cup one). The $20 French press, the $20 milk-frother and the $15 coffee grinder costs me $55, equivalent to only 11 lattes at my local coffee shop).

2) Same goes for my Kombucha addiction (on average $5/ 2-3 times week)

If I was getting roughly 2 Kombuchas per week at $5 average for 52 weeks I was spending $520 per year on Kombucha

*the fix: I still love my fermented drinks as a treat in the afternoon but I try and either go for cheaper options, drink more water, or stock up at stores where I know they’re less expensive (Trader Joe’s sells Kombucha for $2.99!)

3) Try and cut down even more on eating out unnecessarily

When I’m out and I know I don’t have much food at home I’ll always get something to go and bring it back. This past year I developed a huge obsession with salads from Sweetgreen (salads so simple they often resembled something I could easily make at home)

My Sweetgreen salads would on average cost me $11 and I would get them roughly 4 times per month which means at Sweetgreen alone (and I eat out a lot more than just Sweetgreen) I was spending roughly $528 a year.

*the fix: If I know there’s not much food at home, I’ll simply hop into a grocery store close by and stock up. Even if it’s not my weekly huge shop, I can just get the essentials so I at least have enough to make a quick salad.

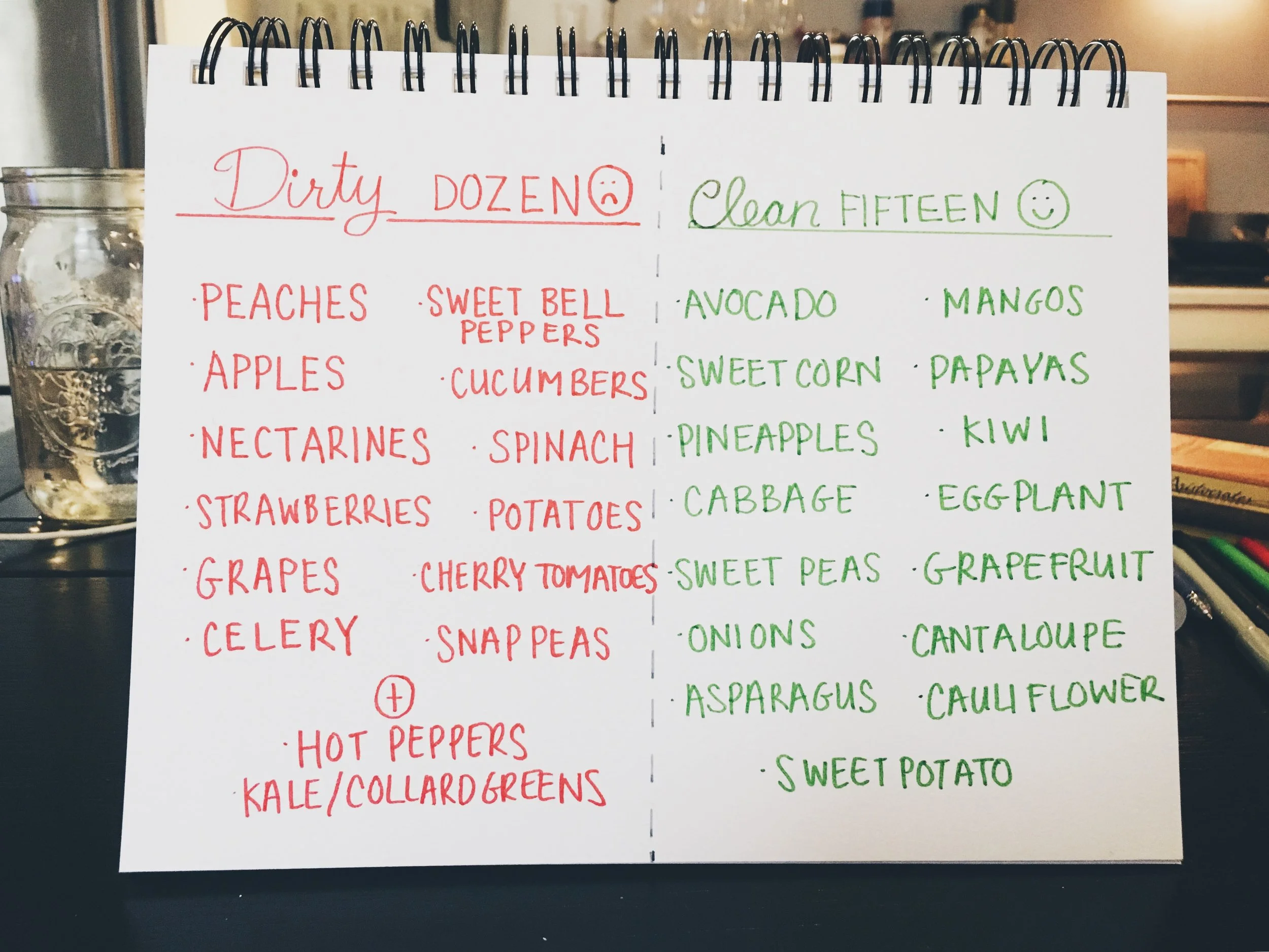

4) The dirty dozen and clean fifteen

This past year I became incredibly obsessed with organic food and clean eating. While I’m not regretting this at all, it definitely took a toll on my budget as eating nearly everything Organic tends to be on the pricier side.

*the fix: A lot of fruits and vegetables have their own outer layer that protect us from the harmful pesticides sprayed on a lot of our food. They’re dangerous to us and so for some fruits and vegetables, it’s imperative to eat organic only so we don’t ingest these harsh chemicals. However, this list helps to monitor your budget while keeping your health in mind:

5) Online yoga

Going to workout classes in the city can be expensive, especially if you want to go to enough to make a difference in your body!

While Yoga to the People is donation based, the recommended $10/class still added up and was often more stressful than relaxing in the New York closet-sized, sardine-packed class.

*the fix: Youtube yoga! Adriene provides free classes that range from 10 minute classes for when you're not feeling well to challenging 50 minute energy boost classes for you to do at your own pace. Check out her youtube channel here!

With these simple tricks in mind and with the help of apps that are incredibly easy to use to monitor such expenses, I’m still living a fun life in New York City but one where I'm smart with my spending and saving so I can invest more for my future.

Image Credit: Wikimedia.org